The Local Multiplier Effect

The Local Multiplier Effect

How Independent Local Businesses help your community thrive

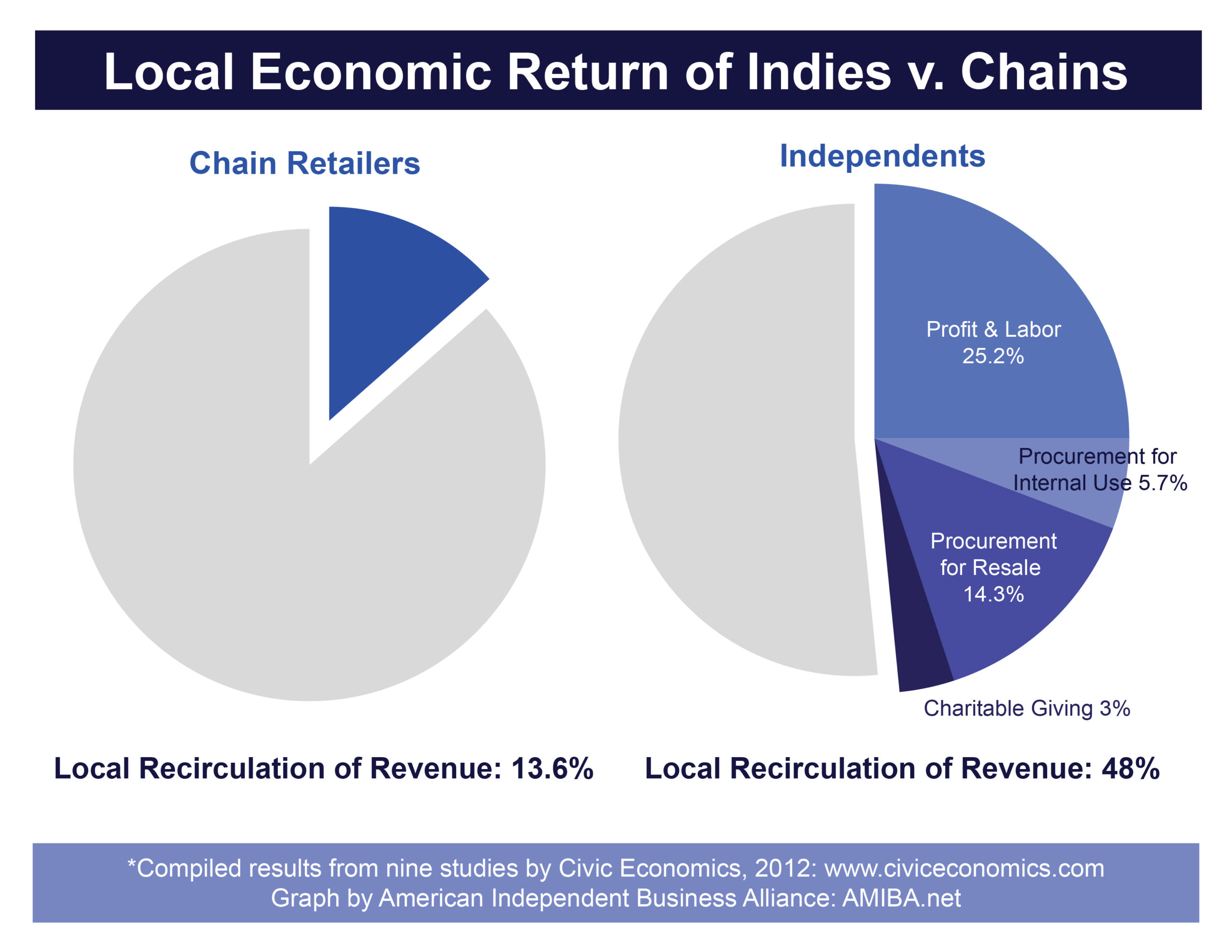

The Multiplier Effect results from the fact that independent locally owned businesses recirculate a far greater percentage of revenue locally compared to absentee-owned businesses. In other words, spending locally creates more local wealth and jobs.

Clearly communicating the importance of the local economic multiplier effect or “local premium” is a key part of effective “buy local” and public education campaigns.